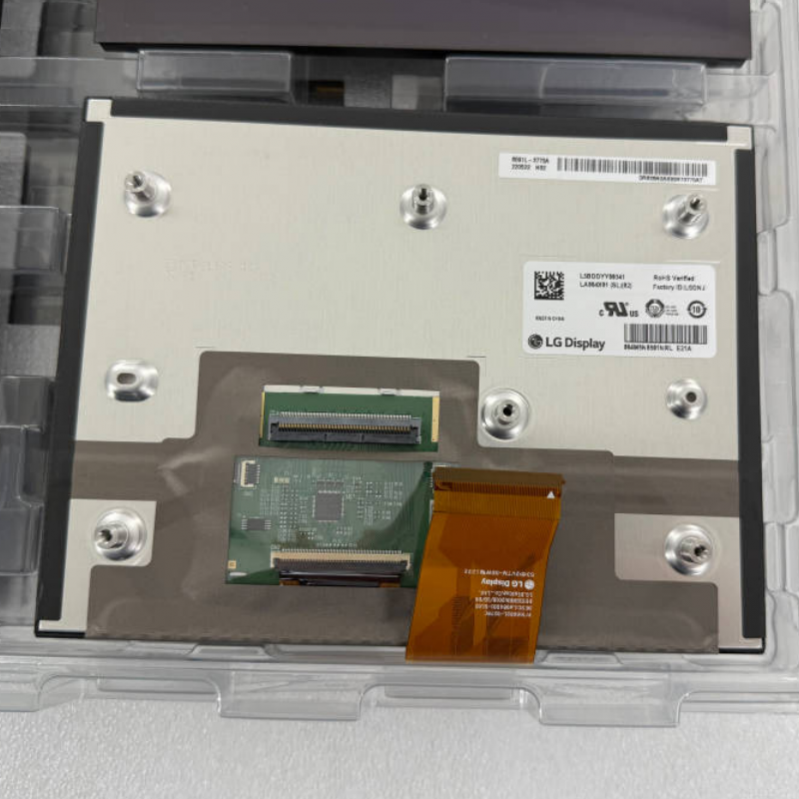

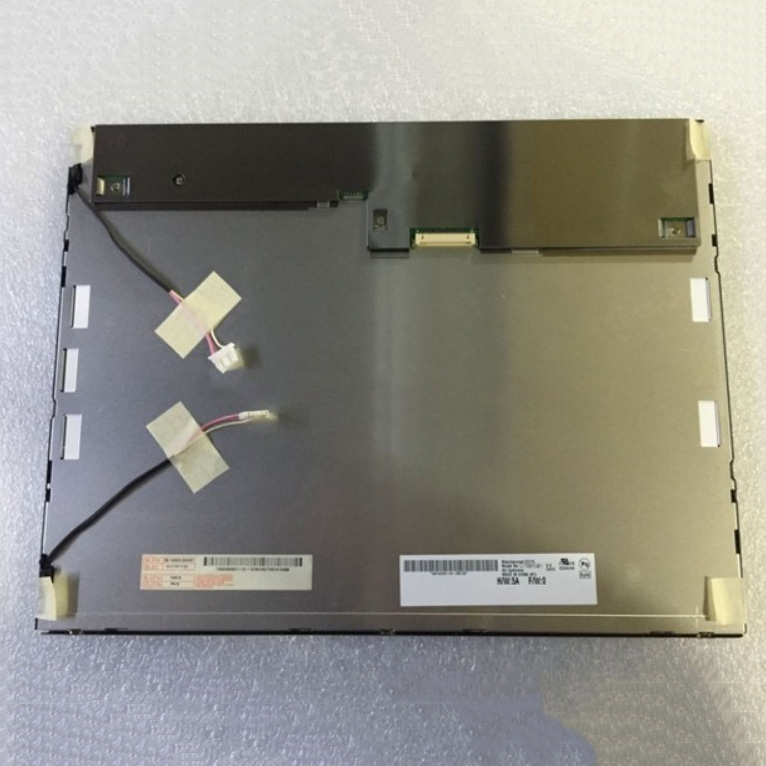

- Industrial LCD display

-

Industrial Products

- DC Servo Drive

- AC Servo Drive

- other

- Heidelberg

- FANUC

- IFM

- Meter

- CCD

- Membrane Keypad

- Film

- YOKOGAWA Module

- Card

- ABB

- MITSUBISHI

- FANUC

- KEYENCE

- BECKHOFF

- Honeywell

- HOLLYSYS

- FUJI servo drives

- HP

- solenoid valve

- thermostat

- Siemens adapter

- color oscilloscope

- Fujitsu connector

- CHELIC

- SMC

- CISCO Module

- INTEL

- Key board

- FAIRCHILD

- Motherboard

- Board

- Bearing

- other

- Control Panel

- Contactor

- Circuit

- OMRON

- Relay

- Controller

- Photoelectric Switch

- Photoelectric Sensor

- Original

- Fan

- Motor Driver

- Limit Switch

- Amplifier

- power supply

- LENZE

- Cable

- Encoder

- Sensor

- Transformer

- Fiber Optic Sensor

- Protection Relay

- Temperature Controller

- Proximity Switch

- Switch Sensor

- Siemens

- Industrial board

- HMI Touch Glass

-

HMI Full Machine Whole unit

- OMRON HMI Touch Panel

- Siemens HMI Touch Panel

- Mitsubishi HMI Touch Panel

- Allen-Bradley automation HMI Touch Panel

- DELTA HMI Touch Panel

- EVIEW DELTA HMI Touch Panel

- KINCO DELTA HMI Touch Panel

- HITECH HMI Touch Panel

- WEINTECK HMI Touch Panel

- TECVIEW HMI Touch Panel

- WEINVIEW HMI Touch Panel

- PRO-FACE HMI Touch Panel

- SIMATIC HMI Touch Panel

- AMPIRE HMI Touch Panel

- HEIDELBERG HMI Touch Panel

- PANASONIC HMI Touch Panel

- PATLITE HMI Touch Panel

- KYOCERA HMI Touch Panel

- KEYENCE HMI Touch Panel

- WEINVIEW HMI Touch Panel

- HITECH HMI Touch Panel

- FUJI HMI Touch Panel

- HAKKO HMI Touch Panel

- SCHNEIDER HMI Touch Panel

- SAMKOON touch panel

- other

- Module

- lcd inverter

- Membrane Keypad Switch

- Winni Touch Screens

- Frequency Inverter

- Servo Motor

- PLC

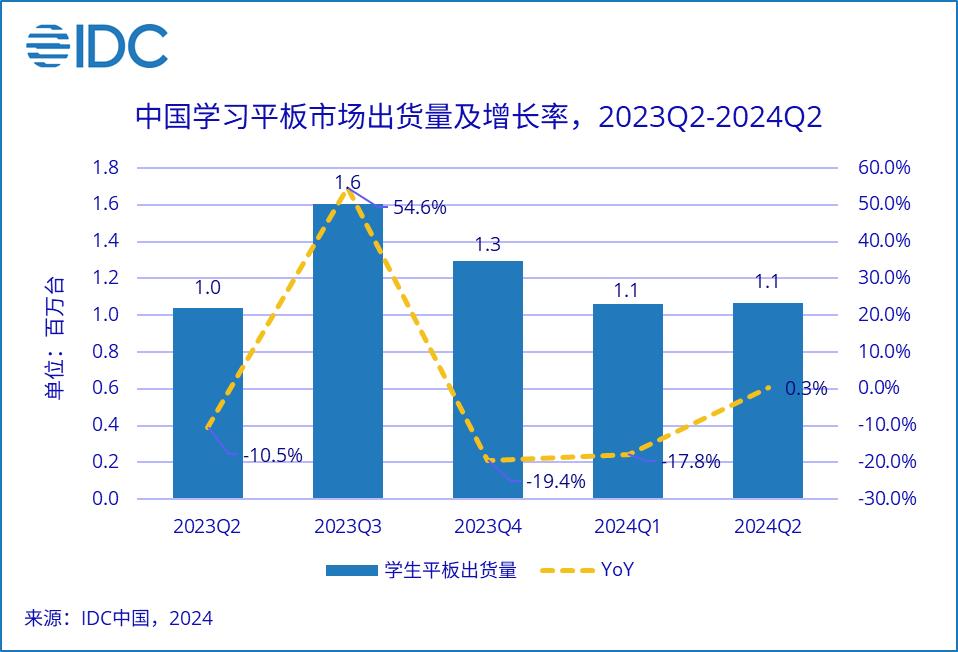

According to the latest report data released by International Data Corporation (IDC), "China Quarterly Tutoring Tablet Tracker", the shipment volume of China's learning tablet market reached 1.065 million units in the second quarter of 2024, a year-on-year increase of 2.7%. In the second quarter, the online promotion saw a slight recovery in the learning tablet market. IDC predicts that China's learning tablet market will show a trend of flat and slight growth in the short term.

Competitive landscape: Intensified competition among manufacturers, intelligent technology and teaching supplementary content have become core competitiveness

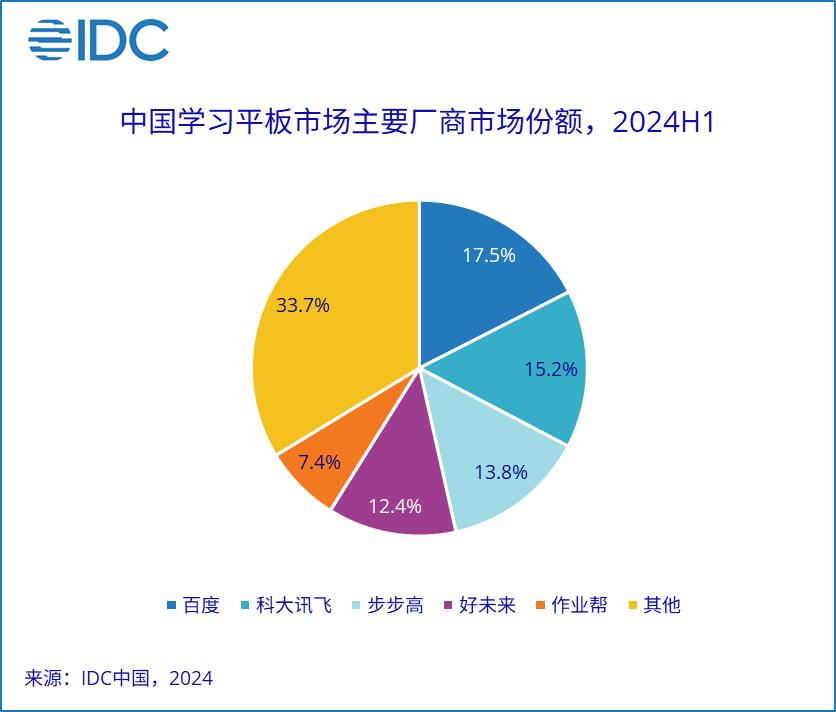

Currently, players in China's learning tablet market are composed of two major camps: "technological" and "educational". Among them, technological brands represented by Baidu and iFLYTEK focus on strengthening the upgrade of product hardware, continuously iterating hardware functions and optimizing system operations to occupy market share; educational brands represented by Good Future and Homework Help focus on the research of high-quality teaching supplementary resources, improving the scarcity and professionalism of learning content to continuously attract consumers.

IDC data shows that in the first half of 2024, Baidu's market share accounted for 17.5%, still ranking first; iFlytek, BBK, TAL, and Zuoyebang ranked second to fifth.

Baidu's market share has declined due to competition from educational brands. On the basis of its deep accumulation of smart education hardware, it has integrated the Wenyan Yixin AI model to help Xiaodu's various product series continue to upgrade; iFlytek performed well in the first half of the year. With its powerful hardware advantages, it pays more attention to user experience, and its intuitive and easy-to-use operating interface is well received by users. BBK's product structure has been upgraded, and its offline channels are still strong. TAL's years of teaching and training experience have created high-quality content barriers, and its high-quality education image has helped the brand gain a foothold in the high-end price range. Zuoyebang relies on its own education platform, with comprehensive coverage of supplementary resources, and the rapid increase in e-commerce channels has helped the brand rank among the top.

Market trend: AI capabilities have leaped, and product innovations have been rapidly iterated

With the continuous advancement of generative AI technology, major manufacturers have developed their own large language models, and their product functions have been continuously innovated, bringing huge improvements to the AI tutoring function, AI voice recognition, knowledge graphs and other functions of learning tablets.

Specifically, after Baidu was paired with Wenyan Yixin, the product's natural language understanding ability was further improved, forming an open communication and interaction with users; iFlytek's user experience has been greatly improved since it was connected to the Spark big model, and AI precision learning and Chinese-English oral dialogue have become the biggest highlights; Future Education has synchronized its own teaching and training experience to create the first 100 billion-level mathematical big model MathGPT in China, with problem-solving and problem-explaining algorithms as the core to become a product competitive advantage; with the improvement of each manufacturer's big model, the product's attractiveness has been further enhanced, accelerating the speed of product iteration in the learning tablet market.

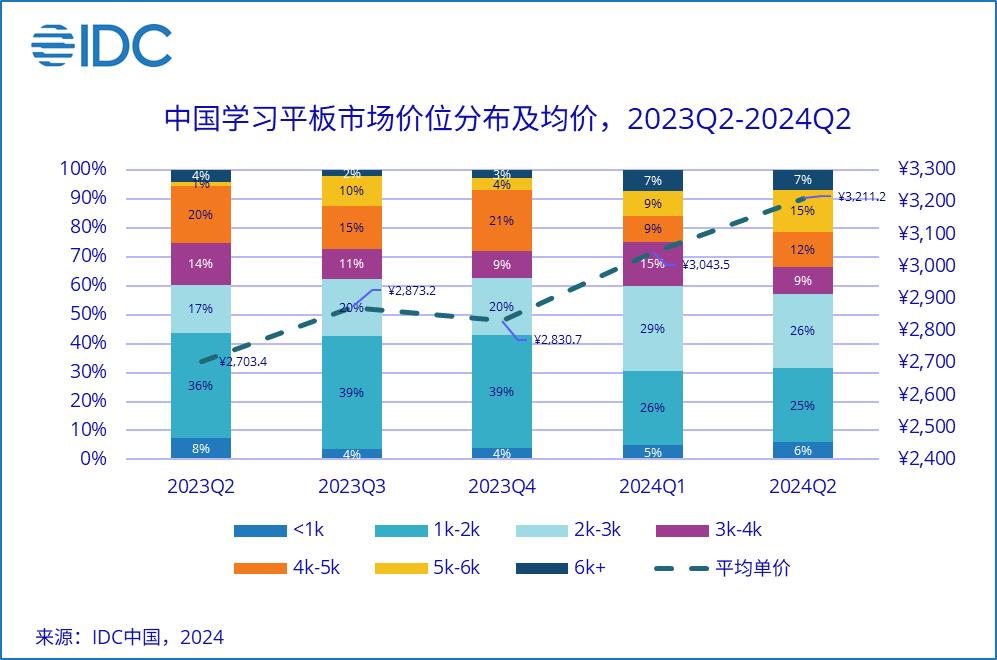

Product development: The average price continues to move up, and the competition in the high-price segment is more intense

With the iteration and upgrade of manufacturers' AI, the average price of the learning tablet market has gradually moved up. The average unit price in the second quarter of 2024 was RMB 3,211, an increase of 5.5% from the previous quarter, and the market unit price has continued to rise. Affected by the release of high-end new products, the 1k-3k price segment has been slightly squeezed, but it is still the mainstream price segment in the market. Competition in high-end products is fierce, and the price segment above 4k has risen significantly, mainly driven by the iteration of Xueersi and BBK flagship products.

From the product perspective, the layout of iFLYTEK P series and Zuoyebang T series in the 2k-3k range has been effective, and the product share has increased significantly; BBK A series products are still at the forefront of the 3k-4k price segment, and Dushulang C series products help the brand to rank among the top; Good Future Xpad series and BBK S series have joined the high-end competition, and the 5k+ price segment has risen significantly. It is expected that the high-end competition of Chinese learning tablets will be more intense in the future.

IDC China analyst Xia Zhengying believes that the current AI development of various Chinese learning tablet manufacturers is relatively homogeneous, and exploring the essence of user needs to create differentiated AI functions can become a new opportunity for manufacturers to develop. Supported by the State Council's new policy "Opinions on Promoting High-Quality Development of Service Consumption", China's education and training industry will usher in a new wave, the market demand and industry development of learning tablets will be further upgraded, and the average price will continue to rise.