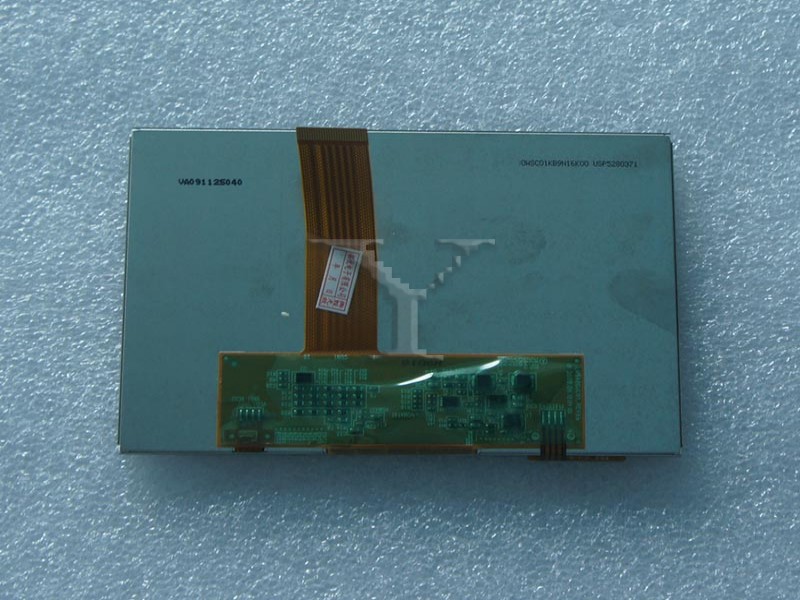

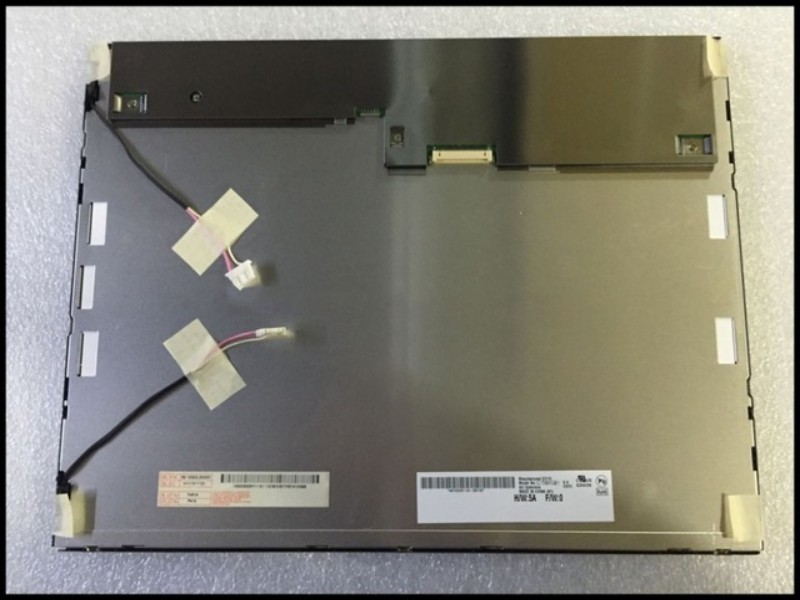

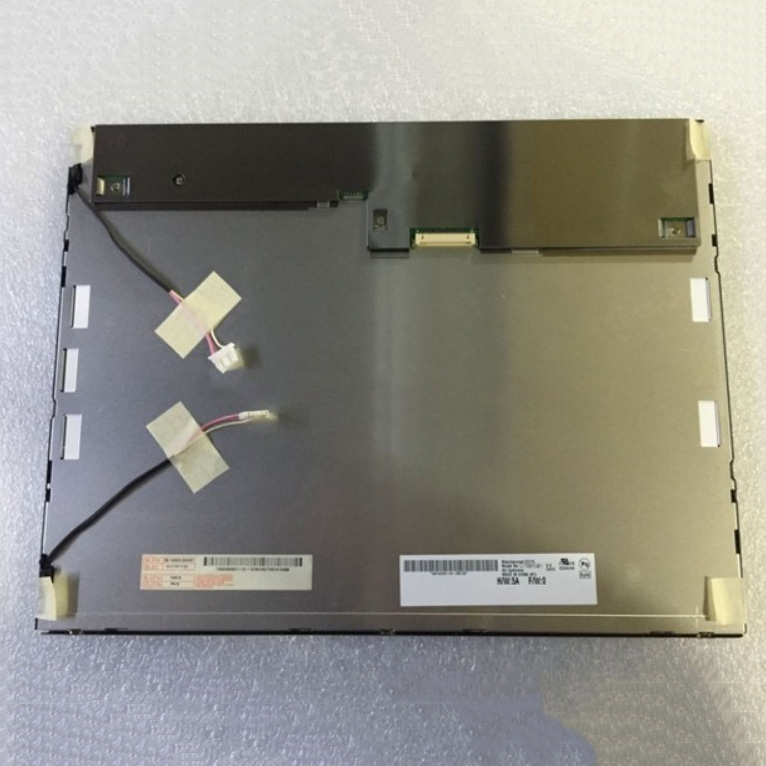

- Industrial LCD display

-

Industrial Products

- DC Servo Drive

- AC Servo Drive

- other

- Heidelberg

- FANUC

- IFM

- Meter

- CCD

- Membrane Keypad

- Film

- YOKOGAWA Module

- Card

- ABB

- MITSUBISHI

- FANUC

- KEYENCE

- BECKHOFF

- Honeywell

- HOLLYSYS

- FUJI servo drives

- HP

- solenoid valve

- thermostat

- Siemens adapter

- color oscilloscope

- Fujitsu connector

- CHELIC

- SMC

- CISCO Module

- INTEL

- Key board

- FAIRCHILD

- Motherboard

- Board

- Bearing

- other

- Control Panel

- Contactor

- Circuit

- OMRON

- Relay

- Controller

- Photoelectric Switch

- Photoelectric Sensor

- Original

- Fan

- Motor Driver

- Limit Switch

- Amplifier

- power supply

- LENZE

- Cable

- Encoder

- Sensor

- Transformer

- Fiber Optic Sensor

- Protection Relay

- Temperature Controller

- Proximity Switch

- Switch Sensor

- Siemens

- Industrial board

- HMI Touch Glass

-

HMI Full Machine Whole unit

- OMRON HMI Touch Panel

- Siemens HMI Touch Panel

- Mitsubishi HMI Touch Panel

- Allen-Bradley automation HMI Touch Panel

- DELTA HMI Touch Panel

- EVIEW DELTA HMI Touch Panel

- KINCO DELTA HMI Touch Panel

- HITECH HMI Touch Panel

- WEINTECK HMI Touch Panel

- TECVIEW HMI Touch Panel

- WEINVIEW HMI Touch Panel

- PRO-FACE HMI Touch Panel

- SIMATIC HMI Touch Panel

- AMPIRE HMI Touch Panel

- HEIDELBERG HMI Touch Panel

- PANASONIC HMI Touch Panel

- PATLITE HMI Touch Panel

- KYOCERA HMI Touch Panel

- KEYENCE HMI Touch Panel

- WEINVIEW HMI Touch Panel

- HITECH HMI Touch Panel

- FUJI HMI Touch Panel

- HAKKO HMI Touch Panel

- SCHNEIDER HMI Touch Panel

- SAMKOON touch panel

- other

- Module

- lcd inverter

- Membrane Keypad Switch

- Winni Touch Screens

- Frequency Inverter

- Servo Motor

- PLC

In recent years, the LCD industry has been undergoing a new round of changes driven by technology iteration, market demand and global industrial chain adjustments. From consumer electronics to industrial scenarios, the application boundaries of LCD technology have been continuously expanded, and the rapid rise of Chinese companies and the strategic transformation of Korean manufacturers have further reshaped the global competitive landscape.

At the market level, the supply and demand relationship has shown a clear differentiation. In the first quarter of 2025, the prices of TV and monitor panels continued to rise, and the price increase of large-size panels of 65 inches and above continued to expand due to the stimulation of domestic trade-in policies and brand manufacturers' stocking needs. In contrast, the notebook computer panel market has been affected by the sluggish global PC shipments, and prices have remained flat for many consecutive months. Manufacturers have turned to focus on product structure upgrades, such as promoting high-end business screens with a ratio of 16:10. As the core of global production capacity, China's LCD panel production will exceed 200 million square meters in 2023, accounting for 73% of the global share. Leading companies such as BOE and Huaxing Optoelectronics continue to exert their strength in the fields of ultra-large size and customization, while Korean manufacturers such as LG Display are accelerating their exit from the LCD market and turning to high value-added tracks such as OLED.

Technological innovation has become the key to the breakthrough of enterprises. Although emerging technologies such as OLED and Micro-LED have impacted the traditional LCD market, LCD has greatly improved color performance and contrast through the integration of technologies such as quantum dots and local dimming. For example, the Micro-LED display screen launched by Nationstar Optoelectronics achieves full-color display with more than 500,000 lamp beads, approaching the level of OLED in terms of fineness. The field of in-vehicle display has become a hot spot for technological innovation. The double-sided ultra-thin screen of Unilumin Technology and the curved touch solution of Microchip have expanded the application scenarios while solving the pain points of the industry. In industrial and medical scenarios, the demand for high-precision and wide-temperature display screens has surged. The embedded solutions launched by companies such as Tianma Microelectronics are driving the evolution of LCD screens from "display tools" to "intelligent interactive terminals."

The diversification of application scenarios has injected new momentum into the industry. In the field of consumer electronics, 4K/8K ultra-high-definition displays and curved screens are still the mainstream trend, but the focus of growth is gradually tilting towards B-end scenarios such as smart cars and smart cities. For example, the smart cockpit screen developed by NavInfo in cooperation with automakers deeply integrates navigation, entertainment and vehicle control systems; the screen-shaped robot of Unilumin Technology realizes seamless connection between advertising display and service in scenes such as airports and shopping malls. In addition, the combination of LCD display with the Internet of Things and 5G technology has spawned emerging products such as smart home control screens and digital cultural and tourism interactive devices, further opening up market space.

Challenges and opportunities coexist. Although Chinese companies have advantages in production capacity and technology, fluctuations in upstream material costs, upgraded environmental protection requirements and international economic and trade frictions are still potential risks. At the same time, the popularization of Mini-LED backlight technology, the explosion of the in-vehicle display market, and the promotion of smart display terminals by the "new infrastructure" policy have brought long-term growth opportunities to the industry. In the future, the LCD display industry will accelerate its upgrade towards "high performance, customization, and scene integration", and Chinese manufacturers, relying on collaborative innovation across the entire industry chain, may continue to lead the global trend in this round of changes.