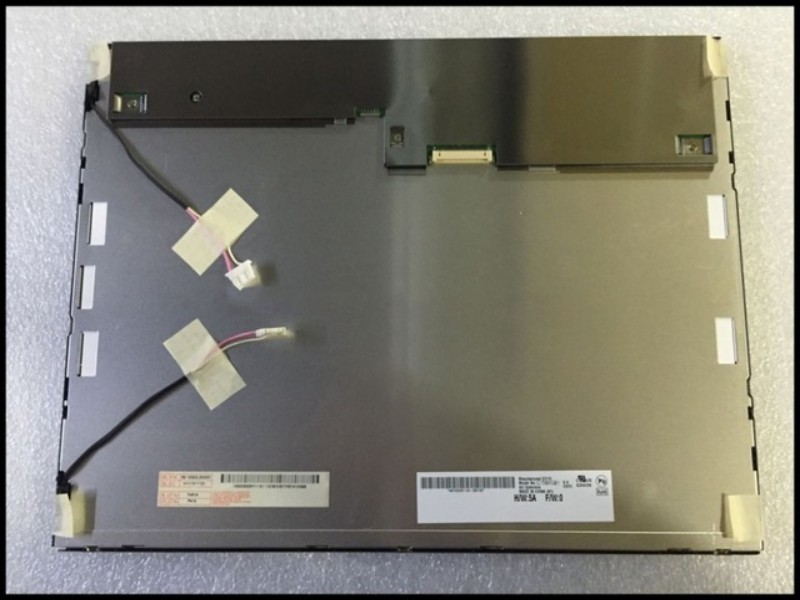

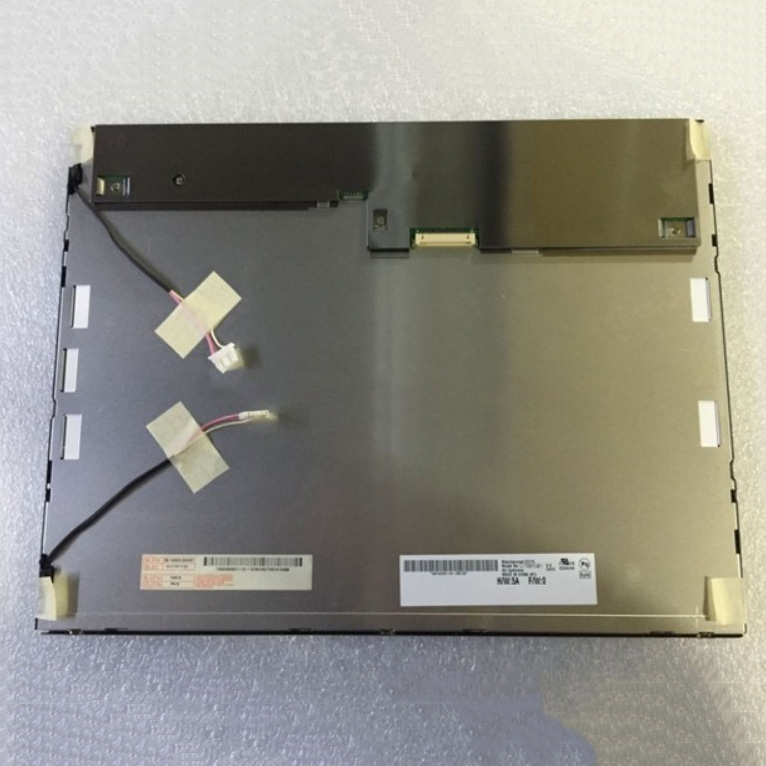

- Industrial LCD display

-

Industrial Products

- DC Servo Drive

- AC Servo Drive

- other

- Heidelberg

- FANUC

- IFM

- Meter

- CCD

- Membrane Keypad

- Film

- YOKOGAWA Module

- Card

- ABB

- MITSUBISHI

- FANUC

- KEYENCE

- BECKHOFF

- Honeywell

- HOLLYSYS

- FUJI servo drives

- HP

- solenoid valve

- thermostat

- Siemens adapter

- color oscilloscope

- Fujitsu connector

- CHELIC

- SMC

- CISCO Module

- INTEL

- Key board

- FAIRCHILD

- Motherboard

- Board

- Bearing

- other

- Control Panel

- Contactor

- Circuit

- OMRON

- Relay

- Controller

- Photoelectric Switch

- Photoelectric Sensor

- Original

- Fan

- Motor Driver

- Limit Switch

- Amplifier

- power supply

- LENZE

- Cable

- Encoder

- Sensor

- Transformer

- Fiber Optic Sensor

- Protection Relay

- Temperature Controller

- Proximity Switch

- Switch Sensor

- Siemens

- Industrial board

- HMI Touch Glass

-

HMI Full Machine Whole unit

- OMRON HMI Touch Panel

- Siemens HMI Touch Panel

- Mitsubishi HMI Touch Panel

- Allen-Bradley automation HMI Touch Panel

- DELTA HMI Touch Panel

- EVIEW DELTA HMI Touch Panel

- KINCO DELTA HMI Touch Panel

- HITECH HMI Touch Panel

- WEINTECK HMI Touch Panel

- TECVIEW HMI Touch Panel

- WEINVIEW HMI Touch Panel

- PRO-FACE HMI Touch Panel

- SIMATIC HMI Touch Panel

- AMPIRE HMI Touch Panel

- HEIDELBERG HMI Touch Panel

- PANASONIC HMI Touch Panel

- PATLITE HMI Touch Panel

- KYOCERA HMI Touch Panel

- KEYENCE HMI Touch Panel

- WEINVIEW HMI Touch Panel

- HITECH HMI Touch Panel

- FUJI HMI Touch Panel

- HAKKO HMI Touch Panel

- SCHNEIDER HMI Touch Panel

- SAMKOON touch panel

- other

- Module

- lcd inverter

- Membrane Keypad Switch

- Winni Touch Screens

- Frequency Inverter

- Servo Motor

- PLC

-

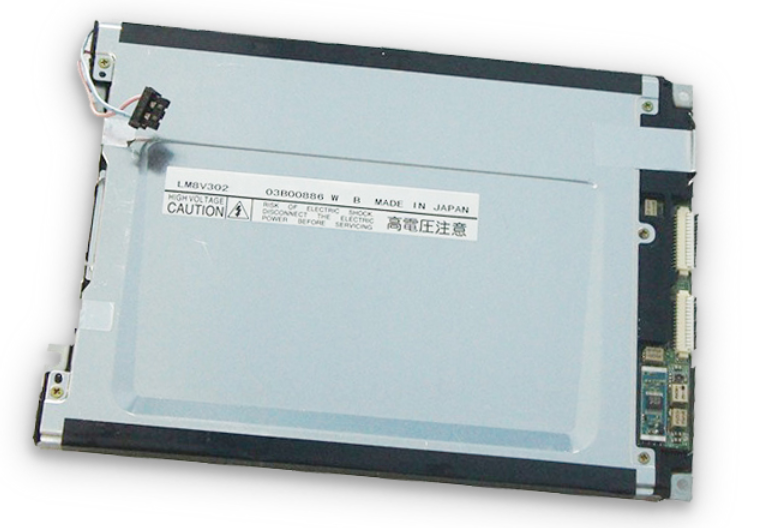

LM8V302 FSTN-LCD FOR SHARP 7.7" 640*480

¥49491.20

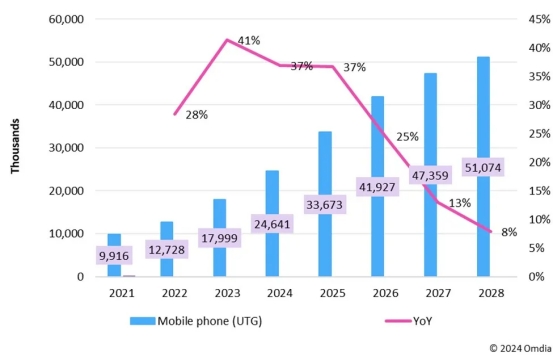

Smartphones are weak, but ultra-thin flexible glass shipments are gaining momentum

Most smartphone brands prefer to use ultra-thin flexible glass (UTG) with higher flatness as foldable cover materials. Nowadays, various UTG solutions are emerging, and most Chinese brands choose to use the thinning method.

Most smartphone brands prefer to use UTG with higher flatness as foldable cover materials

Foldable cover glass must meet all the following standards: transparent, foldable, strong, flat and thin, these basic elements are indispensable. Among them, hardness and thickness are a pair of contradictions, and it is difficult to have both strong and thin. So far, the industry has not found the perfect foldable cover material. Colorless polyimide (CPI) and UTG are two available foldable cover glass solutions, but both still have flaws.

In contrast, most smartphone brands prefer to use UTG with higher flatness. At present, except for Huawei and Honor, which are still using CPI, other brands (including Samsung, Google, Xiaomi, OPPO, vivo, Moto and Transsion) use UTG as foldable cover materials. Omdia research found that Huawei and Honor are also actively developing UTG solutions and are expected to use this material on their new generation of foldable phones.

Therefore, Omdia expects UTG shipments to grow to 24.6 million units in 2024, a year-on-year increase of 36.9%, and to climb to 33.7 million units in 2025, a year-on-year increase of 36.7%. In the next few years, the compound annual growth rate (CAGR) of UTG shipments will maintain a good growth momentum.

Nowadays, various UTG solutions are emerging in an endless stream, and most Chinese brands choose to use the thinning method

Nowadays, various UTG solutions are emerging in an endless stream, which can be mainly divided into the following three types.

The first one is dominated by Samsung Display (SDC). Schott is responsible for the supply of mother glass; Dowooinsys, which is controlled by SDC, is responsible for the finishing of cover glass; then, SDC is responsible for the bonding process of UTG and foldable display panels.

The second one is similar to the first one, but the supply chain is dominated by SEC. Corning is responsible for supplying UTG mother glass, but to distinguish it from Schott UTG, Corning named it Corning Bendable Glass (CBG). SEC chooses SEC to choose eCONY for cover glass finishing. The bonding process is still handled by SDC. Galaxy Z Flip3, Flip4 and Flip5, three folding phones, all use this solution. The third solution is thinning: some cover glass finishing manufacturers will thin the thicker glass from 100µm to 30µm (or 40-50µm) according to customer requirements when processing UTG. This solution has been used in Moto Razr 2022, Moto Razr 40 series, vivo X Flip, OPPO Find N3 series and Transsion Tecno Phantom V series folding phones. Brands using this solution can freely choose the supplier of mother glass, thereby increasing the freedom of the supply chain. But the disadvantage is that due to the additional thinning process, the finishing process becomes more complicated. In addition, glass manufacturers in mainland China are also actively developing 30µm ultra-thin mother glass, which is expected to be put into mass production by the end of 2024.