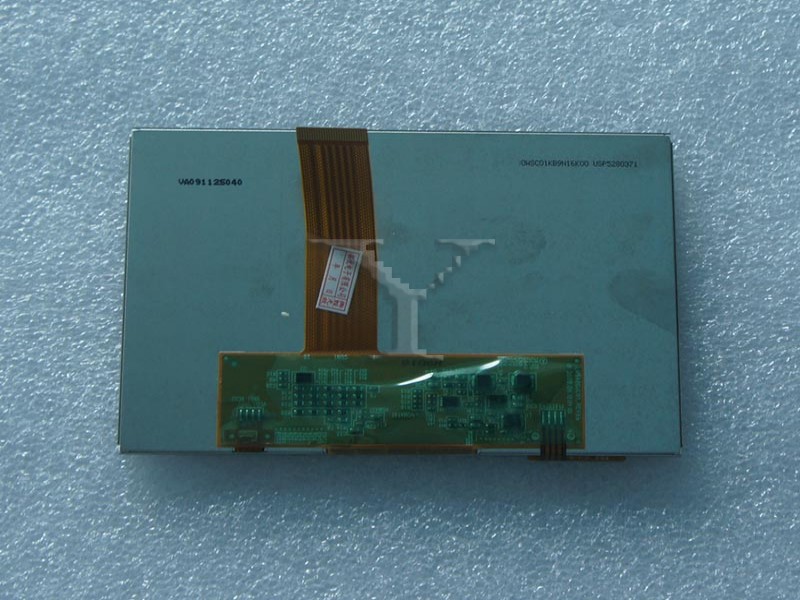

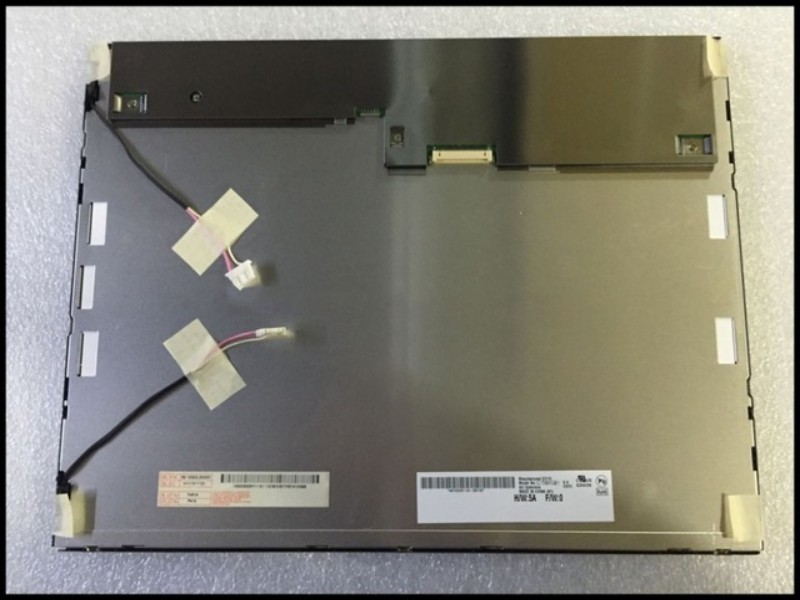

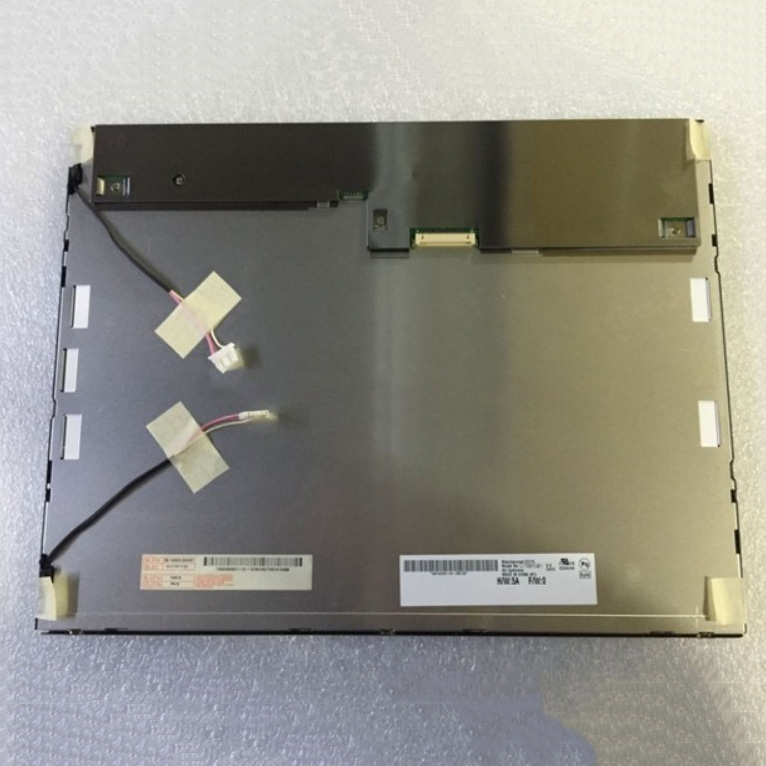

- Industrial LCD display

-

Industrial Products

- DC Servo Drive

- AC Servo Drive

- other

- Heidelberg

- FANUC

- IFM

- Meter

- CCD

- Membrane Keypad

- Film

- YOKOGAWA Module

- Card

- ABB

- MITSUBISHI

- FANUC

- KEYENCE

- BECKHOFF

- Honeywell

- HOLLYSYS

- FUJI servo drives

- HP

- solenoid valve

- thermostat

- Siemens adapter

- color oscilloscope

- Fujitsu connector

- CHELIC

- SMC

- CISCO Module

- INTEL

- Key board

- FAIRCHILD

- Motherboard

- Board

- Bearing

- other

- Control Panel

- Contactor

- Circuit

- OMRON

- Relay

- Controller

- Photoelectric Switch

- Photoelectric Sensor

- Original

- Fan

- Motor Driver

- Limit Switch

- Amplifier

- power supply

- LENZE

- Cable

- Encoder

- Sensor

- Transformer

- Fiber Optic Sensor

- Protection Relay

- Temperature Controller

- Proximity Switch

- Switch Sensor

- Siemens

- Industrial board

- HMI Touch Glass

-

HMI Full Machine Whole unit

- OMRON HMI Touch Panel

- Siemens HMI Touch Panel

- Mitsubishi HMI Touch Panel

- Allen-Bradley automation HMI Touch Panel

- DELTA HMI Touch Panel

- EVIEW DELTA HMI Touch Panel

- KINCO DELTA HMI Touch Panel

- HITECH HMI Touch Panel

- WEINTECK HMI Touch Panel

- TECVIEW HMI Touch Panel

- WEINVIEW HMI Touch Panel

- PRO-FACE HMI Touch Panel

- SIMATIC HMI Touch Panel

- AMPIRE HMI Touch Panel

- HEIDELBERG HMI Touch Panel

- PANASONIC HMI Touch Panel

- PATLITE HMI Touch Panel

- KYOCERA HMI Touch Panel

- KEYENCE HMI Touch Panel

- WEINVIEW HMI Touch Panel

- HITECH HMI Touch Panel

- FUJI HMI Touch Panel

- HAKKO HMI Touch Panel

- SCHNEIDER HMI Touch Panel

- SAMKOON touch panel

- other

- Module

- lcd inverter

- Membrane Keypad Switch

- Winni Touch Screens

- Frequency Inverter

- Servo Motor

- PLC

Recently, market research and research organization Omdia released its latest forecast, pointing out that the industrial display market in 2024 will be affected by the comprehensive impact of the macroeconomic environment. Shipments are expected to achieve slight growth, with a year-on-year increase of 0.4%, with a total volume reaching 193 million pieces. Among them, the shipments of the top five panel manufacturers in the industry are particularly eye-catching, and are expected to reach 165 million units, accounting for 85% of the overall market shipments. From the perspective of financial performance, as panel manufacturers gradually deepen their vertical integration strategies, the revenue of the industrial display market is expected to achieve significant growth in 2024, with a year-on-year increase of 12% and total revenue reaching US$2.9 billion.

Looking forward to the future trends of industrial control panels, three major directions deserve attention:

Vertical integration is accelerating: Panel manufacturers are actively shifting to a vertically integrated business model to further expand vertical markets. Faced with the uncertainty of market recovery, it is expected that panel manufacturers will focus more on revenue growth in 2025 rather than simply pursuing shipments.

ODM brand integration is a win-win situation: ODM companies enhance hardware demand by acquiring brands, which is expected to promote a more competitive price strategy. Touch display module suppliers will face dual competitive pressure from panel manufacturers and ODM manufacturers, prompting the supply chain structure to be restructured.

Software and AI lead brand transformation: Brand manufacturers are gradually reducing their reliance on hardware and instead increasing investment in software capabilities and AI development. By focusing on application service software design, brand companies are expected to achieve profit growth that is no longer limited by hardware specifications and further broaden their profit margins.

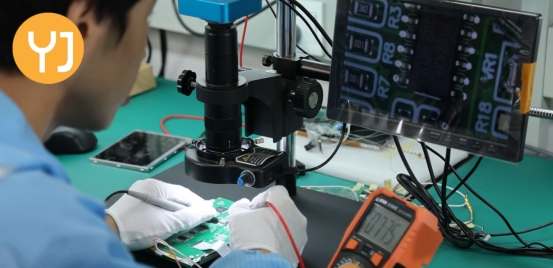

When buying industrial control displays, look for WINNI, which has 16 years of experience and is trustworthy.