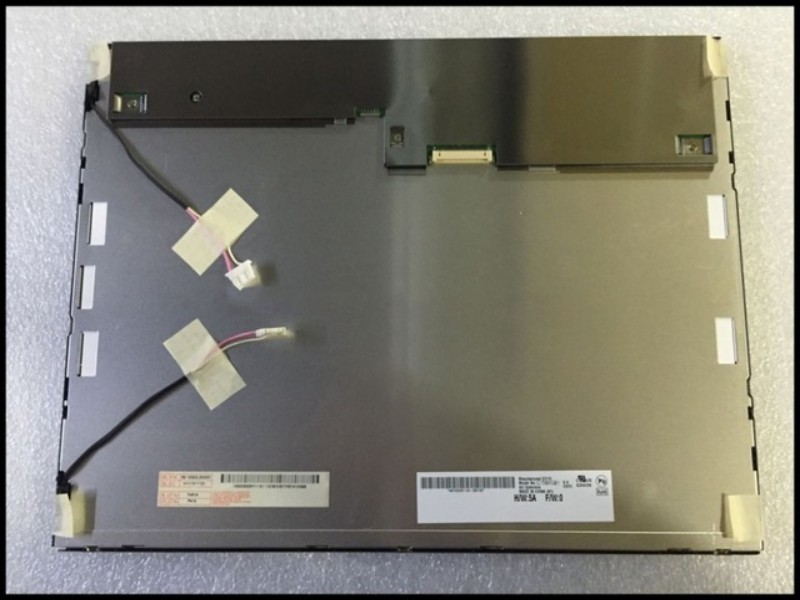

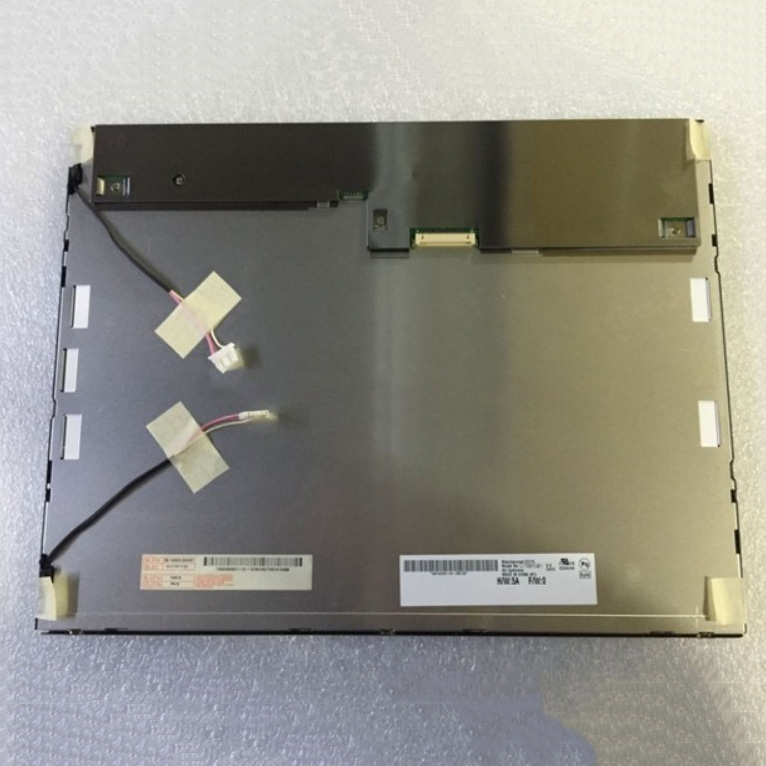

- Industrial LCD display

-

Industrial Products

- DC Servo Drive

- AC Servo Drive

- other

- Heidelberg

- FANUC

- IFM

- Meter

- CCD

- Membrane Keypad

- Film

- YOKOGAWA Module

- Card

- ABB

- MITSUBISHI

- FANUC

- KEYENCE

- BECKHOFF

- Honeywell

- HOLLYSYS

- FUJI servo drives

- HP

- solenoid valve

- thermostat

- Siemens adapter

- color oscilloscope

- Fujitsu connector

- CHELIC

- SMC

- CISCO Module

- INTEL

- Key board

- FAIRCHILD

- Motherboard

- Board

- Bearing

- other

- Control Panel

- Contactor

- Circuit

- OMRON

- Relay

- Controller

- Photoelectric Switch

- Photoelectric Sensor

- Original

- Fan

- Motor Driver

- Limit Switch

- Amplifier

- power supply

- LENZE

- Cable

- Encoder

- Sensor

- Transformer

- Fiber Optic Sensor

- Protection Relay

- Temperature Controller

- Proximity Switch

- Switch Sensor

- Siemens

- Industrial board

- HMI Touch Glass

-

HMI Full Machine Whole unit

- OMRON HMI Touch Panel

- Siemens HMI Touch Panel

- Mitsubishi HMI Touch Panel

- Allen-Bradley automation HMI Touch Panel

- DELTA HMI Touch Panel

- EVIEW DELTA HMI Touch Panel

- KINCO DELTA HMI Touch Panel

- HITECH HMI Touch Panel

- WEINTECK HMI Touch Panel

- TECVIEW HMI Touch Panel

- WEINVIEW HMI Touch Panel

- PRO-FACE HMI Touch Panel

- SIMATIC HMI Touch Panel

- AMPIRE HMI Touch Panel

- HEIDELBERG HMI Touch Panel

- PANASONIC HMI Touch Panel

- PATLITE HMI Touch Panel

- KYOCERA HMI Touch Panel

- KEYENCE HMI Touch Panel

- WEINVIEW HMI Touch Panel

- HITECH HMI Touch Panel

- FUJI HMI Touch Panel

- HAKKO HMI Touch Panel

- SCHNEIDER HMI Touch Panel

- SAMKOON touch panel

- other

- Module

- lcd inverter

- Membrane Keypad Switch

- Winni Touch Screens

- Frequency Inverter

- Servo Motor

- PLC

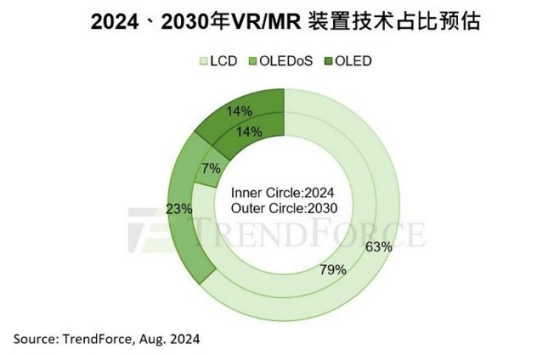

WINNI Special News According to the latest report from TrendForce, VR/MR device shipments are expected to reach 37 million units by 2030, with a compound annual growth rate (CAGR) of 23% between 2023 and 2030. Among these devices, OLEDoS technology will dominate the high-end market, with a market share expected to reach 23%. LCD technology will continue to occupy the mainstream market, with a share of 63% in near-eye displays.

Specifically, OLEDoS technology has been adopted by major manufacturers such as Sony and Apple due to its advantages of high resolution and high luminous efficiency, and has dominated the high-end VR/MR market. However, due to the complexity of CMOS manufacturing technology and low yield, the production cost of OLEDoS screens is relatively high, which may limit its penetration.

On the other hand, despite the challenges of other new display technologies, LCD technology will continue to maintain strong competitiveness in the low-end and mid-end markets through continuous optimization and upgrading (such as improved liquid crystal materials and improved backplane technology). In addition, Chinese panel manufacturers also occupy an important position in the global LCD market, further consolidating the dominance of LCD technology in the mainstream market.

TrendForce estimates that the shipment scale of LCD near-eye display products will be 6.8 million units in 2024, a decrease of about 5.6% from 2023. In the mainstream near-eye display device market, LCD technology has always dominated due to Meta's consideration of cost performance. However, these devices continue to pursue higher resolution and image quality, and LCD products have only a display specification of 1,200 PPI, which has already faced challenges from other technologies.

TrendForce pointed out that there is still room for optimization of various complex components of LCD. For example, improving liquid crystal materials to reduce dizziness, and upgrading backplane technology to increase resolution to 1,500 PPI. BOE has invested a lot of development resources in the application of LCD in near-eye display, so that the display specifications of LCD in VR/MR devices are constantly updated and iterated, which will maintain the strong competitiveness of this technology in the mid- and low-end markets.

In the OLED production process, the luminescent material after evaporation cannot completely cover the display screen, which easily deepens the "screen window effect" when the VR/MR device is used. TrendForce said that OLED technology is not as competitive as OLEDoS in the high-end market, and its cost-effectiveness cannot match that of LCD products. In addition, OLED applications in the VR/MR market mostly rely on specific manufacturers, and its penetration rate has been limited for a long time. TrendForce estimates that between 2024 and 2030, the technology share of OLED in the VR/MR market will remain at 13% to 15%.